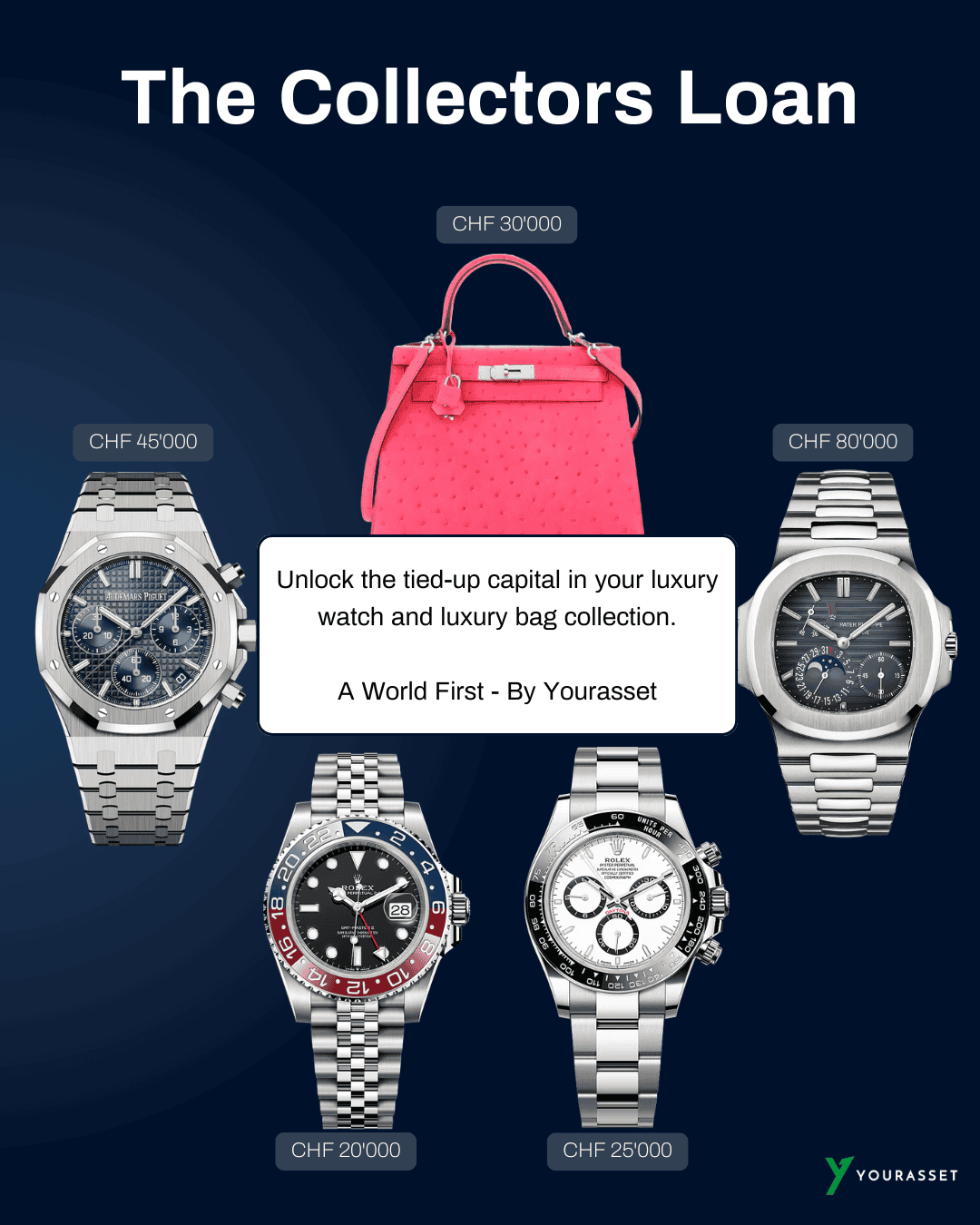

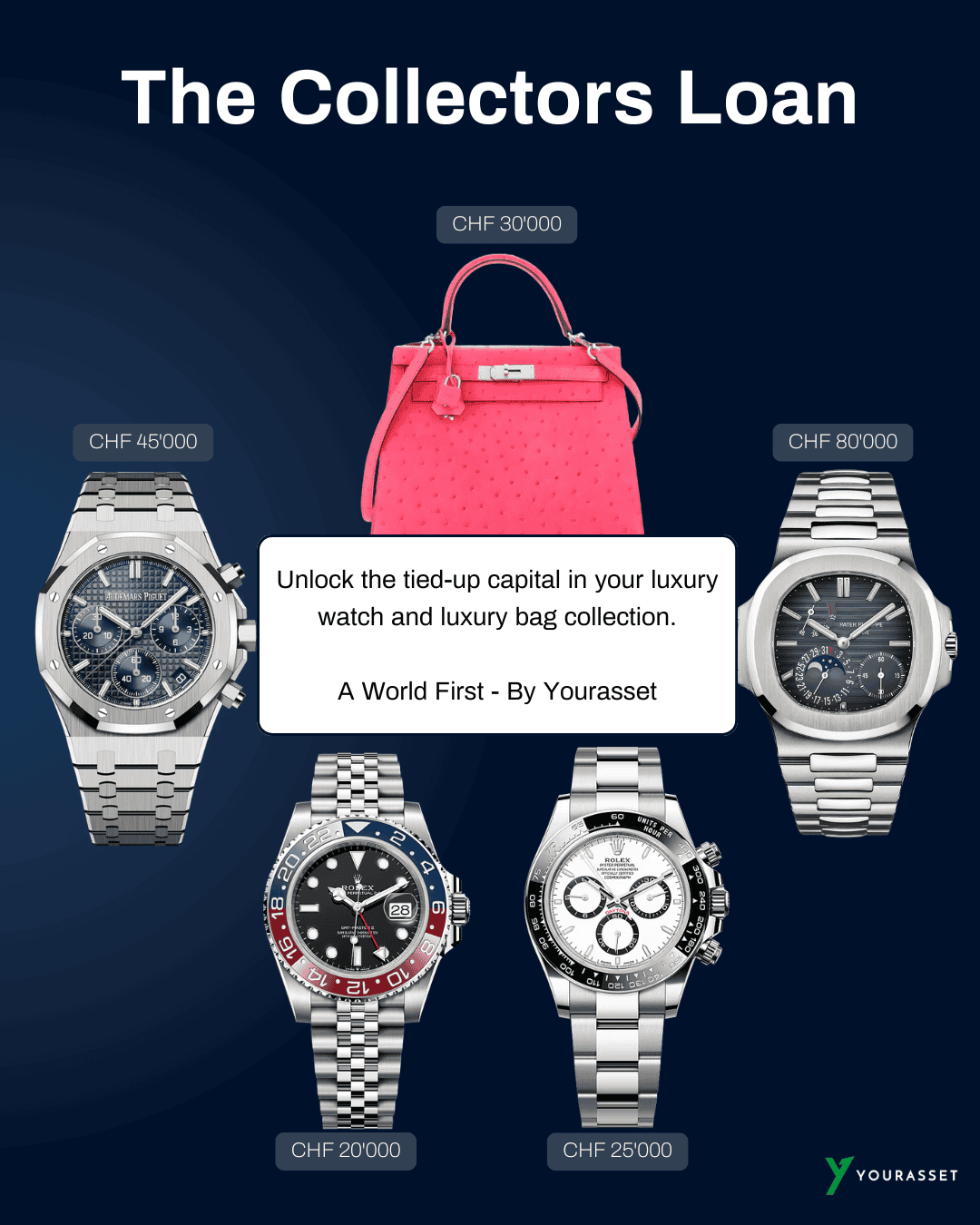

The Collectors Loan

The Collectors Loan. The first in the world for luxury assets. Yourasset together with its financing partner in Switzerland allow you to unlock the tied-up capital in your luxury watch and luxury bag collection. For the first time by any provider worldwide. Read more below and unlock the value of your luxury asset collection.

The Collectors Loan - How it works

You are a Collector and own luxury watches or bags from top Brands like Rolex, Patek Philippe, Audemars Piguet, Richard Mille, Hermes and Chanel.

With the Collectors Loan you can unlock the tied-up capital in your luxury asset collection and use the capital for other purposes.

How it works - Explained using an example Collector situation

- Your Collection consists of # of watches with a total market value of CHF 200'000

- Yourasset defines the amount for your collectors loan with e.g. CHF 140'000

- You verify your collection via one of our Swiss merchant partners

- You submit your financing request with personal and financial information

- You can receive up to CHF 140'000 in liquidity from our financing partner

- You keep your watch and bag collection and must not deposit it with us

- Your Collection must be insured via one of our insurance partners

- You can sell watches from your collection after discussing it with us

Apply for your Collectors Loan

Do you want to know how much your collection is worth and what the maximum financing amount is?

Submit your CollectionThe following luxury brands are considered for the Collectors Loan

In the beginning the Collectors Loan is available for selected brands of luxury watches and bags.

These luxury brands are included

- Watches: Rolex, Audemars Piguet, Patek Philippe, Richard Mille, F.P. Journe, A. Lange & Söhne, Vacheron Constantin and Cartier

- Handbags: Hermès and Chanel

The minimum value of your collection should exceed CHF 50'000

The minimum value of each watch and bag should exceed CHF 5'000

Are you interested in partnering with us?

Yourasset partners with Banks, Private Banks, Auction Houses, Luxury brands and merchants to make the new Collectors Loan possible and accessible.

If you are interested in partnering with us, please write us to collectors.loan@yourasset.com

Use Cases for the Collectors Loan

Purchase a new watch or bag for your collection without spending your own capital

You received the allocation for a waitlisted watch and do not want to sell any watch from your existing collection

Invest the amount of the collector's loan in an investment portfolio, real estate or projects etc.

Benefit from the increase in value of your watch collection, whether purchased at retail price or several years ago, and receive the collectors loan based on market value

For example: If you purchased your watch collection at the retail price of CHF 100'000 and the market value is now CHF 200'000 you can realize the increase in value with the collectors loan

For brands like Patek Philippe and their retail partners, this also means that their customers can benefit from the higher market value without selling watches or flipping them

My initial idea for Yourasset was: Why can't I get a loan against the value of my existing watch collection, secured by the value of my collection? Basically, a similar logic to a Lombard loan for an investment portfolio. I bought my Patek Philippe Nautilus 5711 Piano Dial in 2016 for CHF 21'900 from a retailer. Today, it is worth about CHF 75'000. I would like to use this value to purchase another watch or for an investment, but I would never sell my watch for it. That's why Yourasset's Collectors Loan is the perfect solution. It allows me to access the tied-up equity in my watch collection and I can keep my watches!

CEO & Founder of Yourasset AG

Benefits of the Collectors Loan

Unlock the capital of your collection

Use your capital for other purchases

Keep your assets. You must not deposit them

Use your capital for investments

Attractive financing rates

Continue financing your assets

Frequently asked questions

What are the requirements for applying for the Collectors Loan?

- You must be in possession of a Swiss Passport or have a C residence permit

- You must have income from employment

- The minimum value of your collection should exceed CHF 50'000

- Each watch or bag must have an estimated value of at least CHF 5'000

What is the interest rate on the Collectors Loan?

- Click on the (i) symbol and view the details

- The interest rate is 6.9 % p. a.

Can I sell watches from my collection that are pledged for the Collectors Loan?

- You must inform Yourasset in advance and obtain our approval

- Legally, ownership of your watches and bags remains with our financing partner for the duration of the Collectors Loan

- You can regain ownership of your assets at any time by repaying the Collectors Loan

What options do I have at the end of the Collectors Loan term?

- Yourasset will contact you at least 3 months before the end of the financing term

- You can extend (roll over) the Collectors Loan

- You can sell your watch or bag to Yourasset. We will pay you the difference to the current market price

- You can pay the residual value and take full-ownership again

- You can financing the residual value and take full-ownership again

The Collectors Loan - a World Premiere

Yourasset is proud to realize and to offer the Collectors Loan together with its financing partner in Switzerland. We already have plans to expand this service to Germany and other countries soon.

Yourasset will also be introducing a financing option that takes into account the value of luxury watches and goods. Our customers benefit from more attractive interest rates and lower monthly payments when they purchase luxury watches and bags on finance.

Apply for your Collectors Loan

Are you interested to explore what your asset collection is worth and what the maximum financing amount is?

Submit your CollectionFor question, write us to: contact@yourasset.com